Sobaseki XIII 14-day PI Experiment - Financial Report

A 14-day financial analysis of the Sobaseki XIII P2 colony, covering production output, trade fees, profitability, ROI progression, and scalability limits.

Date: YC127-12-07

Author: Deiter Blitz

Region: Lonetrek

Test Colony: Sobaseki XIII – P2 Supertensile Plastics

Duration: 14 days

This report evaluates the 14-day performance of the Sobaseki XIII test colony, detailing its costs, production output, profitability, and long-term return profile.

1. Colony Costs

| Category | Amount (ISK) |

|---|---|

| Colony Construction Cost | 11,166,000.00 |

| Import/Export Taxes | 481,600.00 |

| Total Operating Expenses | 11,647,600.00 |

2. Output Summary

P2: Supertensile Plastics

- Total Produced: 1280 units

- Unit Sell Price: 13,240 ISK (−2.0%)

- Gross Revenue: 1280 × 13,240 = 16,947,200.00 ISK

- Broker’s Fee (2.81%): 477,231.23 ISK

- Sales Tax (6.67%): 1,131,225.60 ISK

Net Revenue (P2 after taxes/fees):

16,947,200.00 − 477,231.23 − 1,131,225.60

= 15,338,743.17 ISK

P1: Biomass (Unprocessed Leftover)

- Quantity: 780 units

- Unit Sell Price: 748.10 ISK (−4.9%)

- Gross Revenue: 780 × 748.10 = 583,518.00 ISK

- Broker’s Fee (2.82%): 16,431.80 ISK

- Sales Tax (6.67%): 38,949.83 ISK

Net Revenue (P1 after taxes/fees):

583,518.00 − 16,431.80 − 38,949.83

= 528,136.37 ISK

3. Consolidated Revenue

| Source | Net Revenue (ISK) |

|---|---|

| P2 Supertensile Plastics | 15,338,743.17 |

| P1 Biomass | 528,136.37 |

| Total Net Revenue | 15,866,879.54 |

4. Profitability

Total Net Revenue: 15,866,879.54 ISK

Total Operating Expenses: 11,647,600.00 ISK

Net Profit:

15,866,879.54 − 11,647,600.00

= 4,219,279.54 ISK

14-Day ROI:

Net Profit / Expenses = 4,219,279.54 / 11,647,600.00

= 36.24%

Daily Average Profit:

4,219,279.54 / 14

= 301,377.11 ISK/day

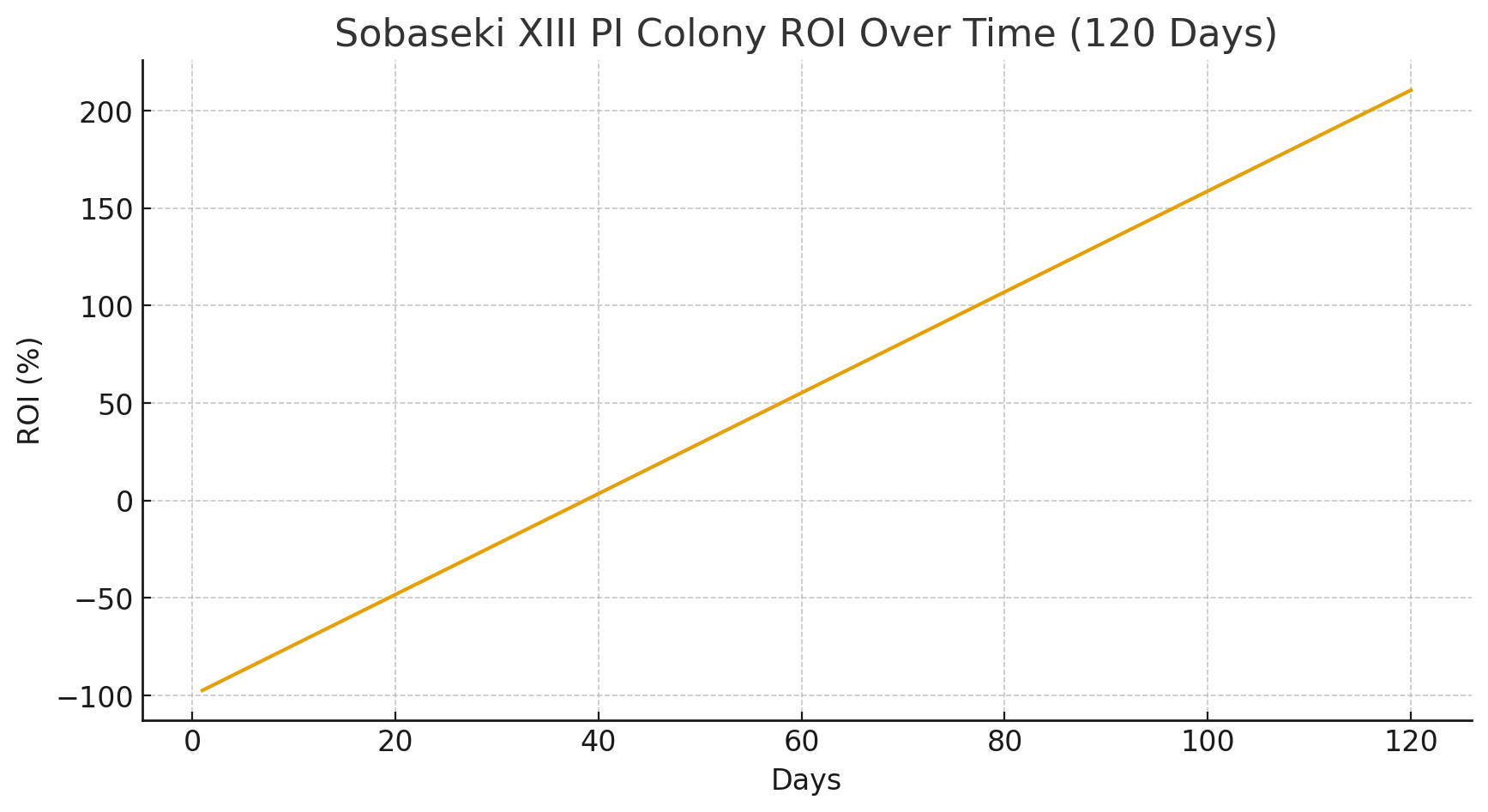

5. ROI Curve and Interpretation

ROI Curve (120 Days)

Interpretation

- The colony begins with a negative ROI because construction cost and initial taxes exceed early revenue.

- Daily net profit of 301,377.11 ISK/day steadily reduces the deficit.

- ROI crosses 0% on day 39, which marks the break-even point. After this point, the colony has fully paid back all initial expenses.

- ROI rises linearly after break-even because operating profit accumulates on a fixed cost base.

- By day 120, ROI reaches ~210%, meaning the colony has produced more than double its initial investment in net profit.

- Continued operation increases ROI without additional fixed costs, which makes long-duration colonies significantly more efficient than short-term tests.

5. Summary

- The Sobaseki XIII test colony returned a 36.24% ROI in 14 days.

- Core revenue came from P2 refinement, which remained profitable even after Jita trade fees.

- Residual P1 contributed a small but positive margin.

- Construction cost dominates expense profile, so extended operation should improve ROI significantly as the fixed cost amortizes over time.

- If scaled to 6 identical Sobaseki XIII colonies, the 14-day net profit would project to 25,315,677.24 ISK, with a daily profit of 1,808,262.66 ISK/day. ROI remains essentially the same because both revenue and operating expenses scale linearly across colonies.

- Even when scaled to all 18 account-available PI slots, the Sobaseki XIII colony model produces only about 162M ISK per 30 days, which is less than 8% of the 2.1B ISK needed to PLEX an account, so this setup cannot sustain account costs through PI alone.